A recently-published Goldman Sachs research note raised next year’s Brent price forecast from $58 to $62 per barrel and its West Texas Intermediate projection from $55 to $57.50 per barrel. The study cited lower inventories and a deal led by the Organization of the Petroleum Exporting Countries as the primary reasons for the rising oil price forecast.

The OPEC-led meeting in Vienna resulted in Russia, Saudi Arabia, and other global producers striking a deal to extend production cuts until the end of 2018. Though the move was telegraphed ahead of time, producers indicated they could exit the deal if the market was overheating.

According to Goldman Sachs analysts, led by Damien Courvalin and Jeffrey Currie, the deal “leaves room for an earlier exit than currently scheduled, we now reflect this resolve in our supply forecast, with full compliance for longer and a more modest exit rate.”

Meanwhile, the move also incentivizes non-OPEC countries to increase their output. The United States, for example, surpassed 9.7 million barrels per day in crude output. Tom Kloza, who runs the Oil Price Information Service, predicts the number will reach 10 million by early 2018. “We may be at a record right now for shale,” he said. “It establishes a stronger bottom for crude oil.”

Goldman agrees that “risks remain, and we see these as skewed to the upside into 2018 on the risk of an over-tightening, either because of new disruptions, demand exceeding our optimistic forecast, or OPEC letting the stock draw run hot.” They also noted that the response of shale oil and other producers to higher prices would likely incentivize OPEC and Russia to scale back their now greater capacity, thus leaving risks to prices skewed towards the downside over the long term.

Kloza maintains that the West Texas Intermediate crude will hover around $55 per barrelversus Goldman Sachs $57.50, while others are predicting much higher increases. “You hear these people talking about $70,” said Kloza. “Look, $70 is possible, but it’s probably as possible as the Jets making it to the Super Bowl. So, it’s very, very improbable. It would take an event. It would take some sort of disruption in Libya or Nigeria beyond what we’ve seen in the last couple of years.”

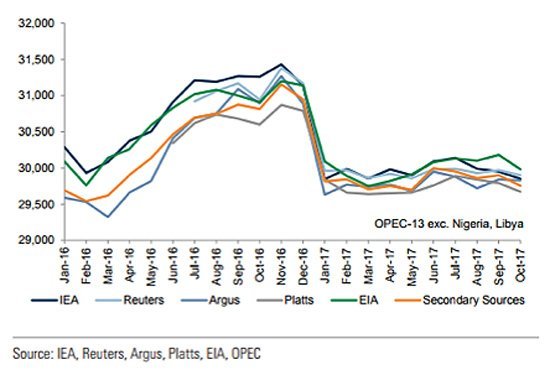

Goldman continues to be optimistic, projecting 350,000 barrels a day above OPEC’s own forecasts and 550,000 barrels above the International Energy Agency’s forecasts.

The sunny predictions only last through next year, however. In 2019, Goldman sees the WTI slipping back to $55 per barrel and Brent to $59.50. In 2020, WTI is estimated at $50 with Brent at $54.50. “Looking further out, we believe that shale and other producers will start to respond to a higher price signal, which may lead OPEC and Russia to more aggressively ramp up within their spare capacity,” said the analysts. “Greater backwardation will, in turn, provide long investors with positive returns despite a spot forecast near current levels, and we forecast +9% crude total returns over the next 12 months.”