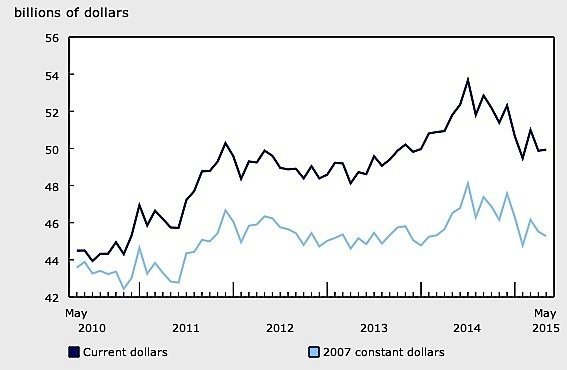

Canada’s manufacturers sold a lower volume of goods in May, though there was a slight increase in sales by dollar value, Statistics Canada reports. It was the second increase in 2015. Sales were up in six of the twenty-one industries in the manufacturing sector.

The largest gains were in the volatile aerospace products and parts industry, which rose 22.2 per cent in May, after a decline of 18 per cent in April. Aerospace sales to date in 2015 are up 7.4 per cent over last year.

Petroleum and coal products also had stronger sales in May, though this is mostly the result of higher prices, Statistics Canada says. Prices in May were 14 per cent higher than in January. Alberta, where manufacturing sales have generally been trending lower, showed an increase of 0.9 per cent in May, on the higher petroleum sales.

A number of industries experienced lower sales, notably chemical products, which were down 3.5 per cent, and machinery manufacturing, also down 3.5 per cent. Food and wood manufacturers also posted lower sales.

In Ontario, declines in multiple industries led to a 1.1 per cent decrease in sales, the fourth decline of the year. The largest dollar decrease was in the transportation equipment industry, down 1.1 per cent after two months of advances. On a year-to-date basis, however, transportation equipment sales in Ontario are up 5.2 per cent over last year.

Unfilled orders declined to $95.5 billion in May, the fourth consecutive monthly decline. Again, the aerospace and transportation equipment industries accounted for the drop, with orders down 1 per cent and 1.2 per cent respectively. New orders, however, rose 1.7 per cent in aerospace.

CBC news reported that an internal report prepared for Industry Canada earlier this year took a pessimistic view of Canada’s manufacturing sector. The report speaks of a “permanent loss of manufacturing capacity” in some industries, and states that manufacturers “underinvest” in their machinery and equipment. With the dollar falling lower, it becomes increasingly difficult to invest. The report also notes that Ontario has lost 214,000 manufacturing jobs since 2004.

Speaking to the Financial Post, the president of the Canadian Steel Producers Association commented that Ontario’s manufacturers are “cautiously optimistic” following the latest interest rate cut by the Bank of Canada. However, the falling dollar and lower interest rates have not yet done as much for manufacturing as many had hoped. What should be happening is that manufacturers and business in general start investing again.

The inability of Canadian manufacturers to compete on costs with countries like China and Viet Nam is another factor working against them. Canada must rely more and more on advanced, highly automated manufacturing, not low-skill, low-paid jobs that can be done elsewhere.