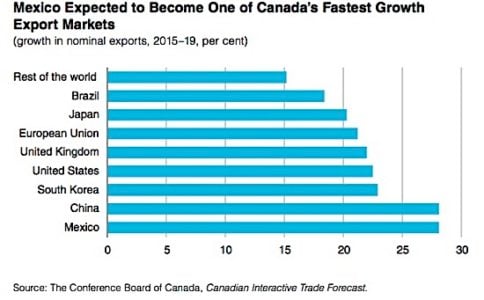

A new report from the Conference Board of Canada and HSBC Bank Canada says that three Canadian industries—primary metal manufacturing, chemical manufacturing, and machinery manufacturing—have the innovative products, demand and capacity to take advantage of the Mexican economy, despite Mexico’s having a clear cost advantage. An additional eleven industries are well positioned to grow their presence in Mexico, though facing challenges of corruption, security and border clearance.

The necessity for Canadian companies to expand their business internationally is paramount, the report says. Those that do so grow faster. Canada has free trade agreements with over fifty countries, including Mexico, yet only 10 per cent of Canadian companies, most of which are small and medium enterprises, currently sell abroad. A mere 550 firms account for 70 per cent of Canadian goods exported. The remaining 30 per cent is divided among 40,000 firms.

Companies looking to grow would do well to look to Mexico, our fifth largest trading partner and one of Canada’s free trade partners since joining NAFTA in 1994. Mexico’s young population, ambitious economic reforms, and status as a major manufacturing hub mean big opportunities for Canadian companies in many sectors; however, they will need truly differentiated products or services, as competing on costs is not an option.

Mexico is particularly attractive to Canadian companies because of the existing free trade agreement, NAFTA, and because Mexico, unlike Canada, has a young population; the median age in Mexico is 26 years, in Canada 42 years. Canada’s aging population will mean a slowing of the economy, according to HSBC, while the Mexican economy is poised for growth, But in order to take advantage of the “big opportunities” presented by Mexico’s booming economy, Canadian companies will have to provide “truly differentiated” products and services. Competing on costs, the report warns, “is not an option.” Canadian companies will have to focus on niche and differentiated products that Mexican firms may not be able to produce, due to lack of expertise or resources.

At present, the most successful exporters to Mexico are the auto industry, agriculture, and the manufacturers of primary metal, chemical, food and machinery products. These six industries accounted for 75 per cent of exports to Mexico in 2015, the report says, with annual shipments ranging from $500 million to $1.2 billion. Exports have risen, except for food products, more than 30 per cent since 2010. Shipments of auto parts have been particularly strong, rising from $432 million in 2010 to $815 million in 2015. Nevertheless, Canada still has a “significant” trade deficit with Mexico, though the amount is not given.

The fourteen Canadian industries identified as having the best prospects for growth in Mexico are:

- Motor vehicle parts manufacturing

- Primary metal manufacturing

- Motor vehicle manufacturing

- Synthetic rubber and fibres manufacturing

- Machinery manufacturing

- Plastics and rubber products manufacturing

- Fabricated metal manufacturing

- Aerospace product and parts manufacturing

- Miscellaneous products manufacturing

- Other transportation manufacturing

- Food manufacturing

- Other chemical manufacturing

- Commercial services

- Transportation services

The auto industry is Mexico’s largest manufacturing industry by far, and the country has now become the biggest exporter of autos and auto parts to the US, making it a major competitor for Canada. However, the report stresses, this also means increased opportunities for those Canadian companies that can “carve themselves a niche” where Mexican firms cannot compete. This will mean offering differentiated products that Mexican firms cannot provide.