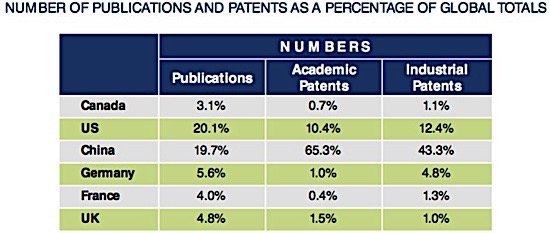

Canada is better at academic research and publishing papers on new cleantech technologies than it is at commercializing those new technologies. A new report from Sustainable Development Technology Canada and Cycle Capital, a venture capital fund manager, says that research, particularly in the areas of transportation and ecomobility, advanced materials, nuclear energy, and air, is stronger than expected in Canada compared to the US. However, the number of academic patents taken by Canadians in those same areas is smaller than expected, again compared to the US. Canada does better on industrial patents, but few Canadians make it into the top fifteen patent assignees in most sectors.

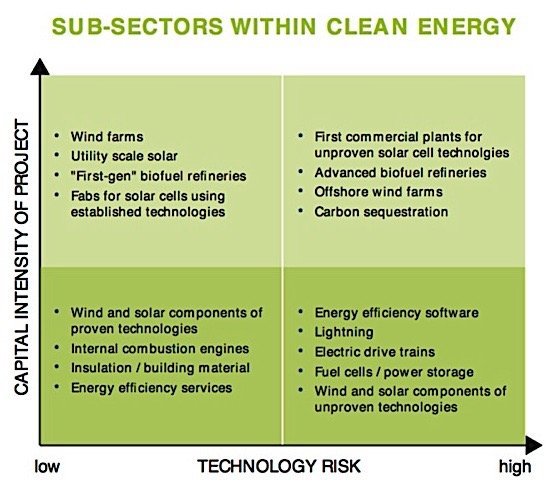

A big problem is financing. The report says that the number of venture capital rounds in Canada is comparable to that in the US, but the relative size of investment per round falls short, at just over half (56 per cent) of US amounts. Since 2010, Canada has had only seventeen venture capital rounds that raised more than $15 million; in the same period in the US there were 406. Five Canadian companies raised more than $50 million, compared to 183 companies in the US. The twenty companies that attracted the largest investments in the US raised between $326 million and $1.2 billion, with an average investment amount of $28 million. In Canada the top twenty companies raised between $20 million and $292 million, with an average investment of $7.5 million. The percentage of US investors who are American is also much higher; 90 per cent versus 60 per cent of Canadian investors.

As part of Canada’s commitment to develop a Pan-Canadian Framework on Clean Growth and Climate Change, the gpvernment set up the Working Group on Clean Technology, Innovation and Jobs. It is mandated to give options on how to stimulate economic growth and create jobs, while driving innovation as the country transitions to a low-carbon economy.

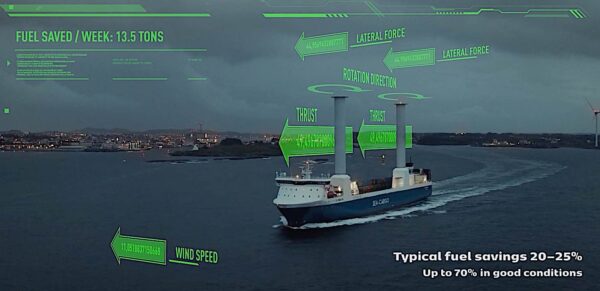

The global cleantech market is already large and growing, especially in emerging countries like China, says the report. Canada, with a mainly resource-based economy, is rated high, nonetheless, for general innovation but low for cleantech-specific drivers like government policies, and R&D expenditure. Global trade in cleantech exports doubled between 2005 and 2014, while Canada’s market share of manufactured environmental goods declined by 41 per cent. Canada’s ranking among the top twenty-four exporting countries fell from fourteenth to nineteenth.

With a relatively weak environment for equity financing in Canada, cleantech companies rely more on foreign investors. This often leads to the companies becoming largely foreign owned, with Canadian investors “marginalized.” That in turn decreases the probability of scaling up independent companies in Canada.

The gap between research into innovation and the creation and financing of start-up companies that can commercialize that research is one of the biggest challenges facing Canada. The relative weakness of Canadian companies to raise venture capital and debt financing is the other major problem. While the Canadian venture capital industry has contributed, over the past decade, to entrepreneurship and the development of tech start-ups, the present challenge is for venture capitalists to take a larger share in later stage rounds to support the scaling up of independent tech companies.

This objective is now “widely accepted,” the report says, and there has been a progressive increase in the size and sophistication of Canadian funds. However, compared to American counterparts, they remain “limited.” Venture debt is also limited in Canada. The only sector in which venture debt plays a major role in Canada is in biofuels and biochemical. It is absent, or near absent, in solar, nuclear, and recycling and waste. There are no Canadian equivalents to the US Department of Energy, Department of Agriculture, and Federal Financing Bank, all government agencies that provide venture debt. In fact, these US agencies are at the present time the largest providers of venture debt to Canadian companies.

Weaknesses in Canada’s cleantech start-up chain

- The low rate of conversion of academic publications into academic patents

- The high proportion of industrial patents that are owned by multinationals’ Canadian subsidiaries and not by companies that originate from Canada

- The absence of global champion based in Canada and the very small number of companies able to raise large rounds in order to scale up

- The relatively small size of Canadian cleantech VC funds and the absence of a large specialized cleantech fund based in Canada able to take a lead role in scale-up financings

- The very low level of involvement of Canadian corporate venture and Canadian corporations in the cleantech financing chain

- The absence of specialized large scale venture debt providers in Canada for early commercialization or technology scaling such as the now closed SDTC managed Next Gen Biofuels Fund17

- In terms of sectors, the low level of Canadian participation in sectors that get a

lot of traction in the US (solar, energy storage, transportation) and the relatively large number of small rounds without larger follow on financing in a great number of sectors