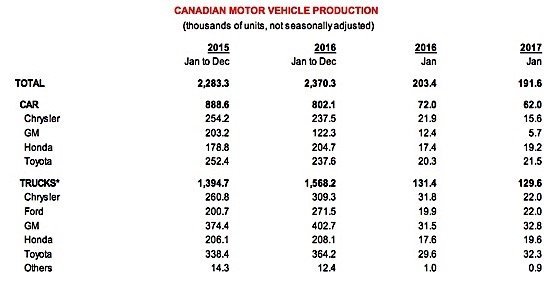

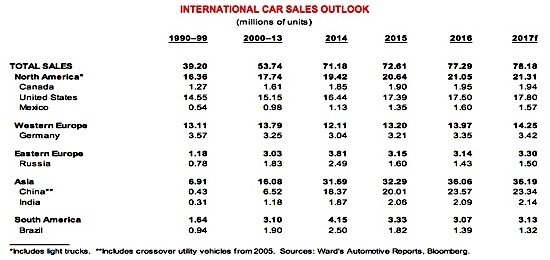

After forecasting a slowdown in auto sales in Canada in 2017 back in January, Scotiabank now says the sector is in much better shape than it appeared then. More recent data shows that Canadian sales set a record high in February, with annualized sales of more than 2 million units that month. January sales also exceeded 2 million units. The Scotiabank Global Auto Report says that nearly 60 per cent of sales to date this year have been in the luxury cars and trucks market, where a 16 per cent surge in sales, mostly in BC and Ontario, accounted for five times their normal share.

Likewise in the American market, where as recently as late February some analysts had been noting a slowdown in auto sales, in part due to uncertainty following the change in administration in Washington, Scotiabank now reports that it expects a record annualized output of 18.3 million units in the second quarter, up from 17.3 million in January. Fleet volumes in the US, on the other hand, have dropped 14 per cent year over year. Nevertheless, Scotiabank is forecasting overall US growth of 2.3 per cent in 2017, up from 1.6 per cent in 2016.

Globally, car sales in the first month of 2017 were up 3 per cent over the previous year, led by strong 9.5 per cent gains in Western Europe.

The Canadian luxury auto market has been heating up in recent months and has accounted for nearly 60% of the year-to-date increase in overall volumes in Canada this year, five times its normal share. The strength of the luxury market is concentrated in British Columbia and Ontario, the fastest-growing provincial economies. Luxury volumes have surged nearly 25%in British Columbia this year, and have advanced 15% in Ontario.

Car sales in emerging markets in Asia, Eastern Europe and South America accelerated 6 per cent year over year. Eastern Europe’s strong performance is attributable to its stronger ties with the EU and higher economic integration with Western Europe, especially Germany. One-third of the Czech Republic’s exports are to Germany, and the Czech Republic has the lowest unemployment rate in the EU (3.4 per cent).

Russia’s auto and labour markets are recovering from deep recession, says Scotiabank, though car sales remained 5 per cent below a year earlier. This, however, is an improvement over the double-digit declines in sales that hit the market for three consecutive years previously and is happening faster than expected. The US analyst IHS Markit is forecasting a growth rate of 8.25 per cent for Russian car sales in 2017, mainly in the second half of the year.

But it is Asia that represents the “key driver” in the global auto market, as labour markets are strengthening. Excluding China, car sales rose 4 per cent in January, more than double the advance in all of 2016. Asian countries account for about half of all car sales in developing markets. China is in a class of its own as the largest car market in the world. Scotiabank forecasts Chinese sales of 23.34 million units in 2017, despite lower sales reported so far, as a result of new sales taxes on vehicles with engines of l.6 litre or smaller.

South America also saw sales rise 4 per cent in January, with higher commodity prices, currency stabilization and improvement in labour markets supporting the growth. Commodities and resource-based manufacturing account for nearly 70 per cent of South America’s exports, double the global average, according to Scotiabank.