Iranian oil-watchers expect a decline of 1.3mn b/d by the end of 2019, based on the sanctions from the U.S. Government. [1] With the situation still in “play” regarding foreign policy, it is not possible to accurately predict pricing, although it’s clear that the sanctions are not priced into Brent currently.

As supply tightens, it is reasonable to expect a run-up in pricing towards the end of 2018. This is because the main sanctions on purchases of Iranian crude are set for November 5. Buyers have not yet significantly moved into compliance with the US rules, but that is likely to change.

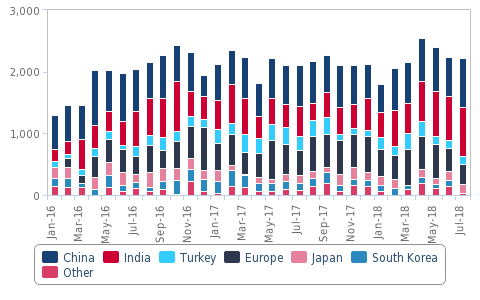

The variable in the mix is certainly the importers. China and India have already started to import more Iranian crude. As compared to January 2016, the volume has significantly increased by July 2018, with China and India dominating overall imports from Iran. The combined volume of these two countries almost outweighs the rest put together (see Bloomberg chart below.) According to Bloomberg data, so far, there has been only small disruptions in overall exports, even though there is an ongoing shift towards increased imports by China and India.:

South Korea has brought important to a virtual zero, Turkey has significantly lowered volume, and much of Europe is unchanged. The situation may change after November 5. However, China and India together represent just over 70% of all imports from Iran.:

Fitch Solutions is standing by their prediction that exports will decline by 1.3mn b/d by the end of 2019, although they project low and high scenarios. China will likely maintain volume, but India likely will reduce volume, possibly significantly. The “low” projections assume full compliance (except for China) with sanctions, while the high assumes non-compliance.

NOTES

[1] Fitch Solutions “Market Unprepared for Loss of Iranian Oil“