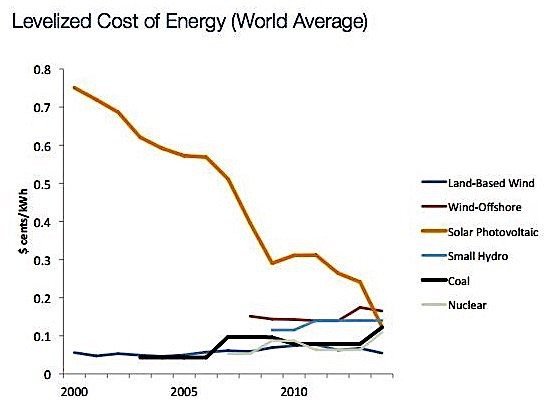

The price of renewable energy has fallen to unprecedented lows, according to a report from the World Economic Forum (WEF). For the first time, solar energy is now cheaper in some parts of the world than energy derived from fossil fuels. Globally, the average cost of electricity from coal and natural gas is around $100 per megawatt hour. The price for solar has plunged from $600 ten years ago to close to $100 for utility-scale photovoltaic. Wind-generated energy is even cheaper, with a levelized cost of electricity of just $50.

The WEF report says that more than thirty countries have already reached grid parity, the point at which alternative energy sources cost the same as or less than energy from traditional sources. Mexico is one of these countries, as are Chile, Brazil and Australia. The WEF projects that by 2020, two-thirds of the world will have reached grid parity, with solar photovoltaic energy costing less than coal or gas-fired generation.

The WEF report makes the point that this has happened despite the fossil fuel energy market receiving more than four times the level of subsidies than those given to renewable energy.

The renewable energy sector has also been boosted by developments in energy storage technology. Spurred on by the growth in electric vehicle markets, the average price of battery packs has dropped from $1000/kWh to $350/kWh in 2015. This cost is projected to drop further as electric vehicles become more common and battery production increases.

Investment in renewables has also grown, reaching a new high of $285.9 billion in 2015. This was also the first year in which the majority of new global power-generation capacity was in renewables, not including hydro. China led the world in investment in renewables with $156 billion, more than the developed markets combined, at $130 billion.

Rapid technological advances and economies of scale have moved renewable energy from niche asset-class status restricted to investors with impact mandate to a sound stand- alone investment proposition. No longer classified as frontier technology, renewable energy has gotten much closer to utility-like infrastructure investments—and indeed outpaced fossil-fuel energy investment globally in 2015.

A case study in the WEF report highlights the Caisse de dépôt et placement du Québec (CDPQ), Canada’s second-largest pension fund manager. It has invested US$2.5 billion in wind energy projects around the world, including the Thames estuary’s London Array if 175 wind turbines. It also invested in North America’s largest independent wind developer, Invenergy of Chicago, which operates nearly seventy wind farms with a total capacity of 7,654 MW. CDPQ’s original investment of $500 million has since grown, giving returns of $1.5 billion, according to the WEF. This, the report says, “outshone” the returns of CDPQ’s infrastructure portfolio.

As for the future of renewables in Canada, McGill University professor Christopher Barrington-Leigh says it is bright. He writes that Canada’s challenges include the vast size of its territory and lack of grid connectivity, its energy-demanding climate, and its dispersed population. Despite these challenges, eight of the ten provinces already have the potential to meet energy demands with renewable energy, mostly wind power.

The shift to renewable power is “inevitable” now that carbon pricing is coming into effect, and market costs to build and operate wind and solar power are dropping. By 2022, it will be cheaper to build and provide a gigawatt of wind power than the cheapest fossil-fuel alternative. Because wind and solar are technologies, not fuels, their costs will continue to drop.