What could be the most talked-about pipeline in history, the Keystone XL, is still being talked about, not built. But some of those talking about the 1,900-kilometre line are very high profile and are in favour of it. It remains to be seen whether their prominence will matter, but the head of the powerful American Petroleum Institute is not a bad ally to have presumably. Jack Gerard, president and CEO of API said that his organization was “as frustrated as anyone else is” by the delays in getting the pipeline approved, but vowed that they would not give up in their efforts to see the pipeline built. He called it a “no-brainer” that would boost domestic energy and jobs in the US.

Gerard made the comments to an audience of oil and gas producers, policy analysts, lobbyists and reporters, while presenting the API’s annual State of American Energy report. The project is to be paid for by the private sector, “without a dime of taxpayer money,” he noted, and the president could move it forward with a simple “yes.”

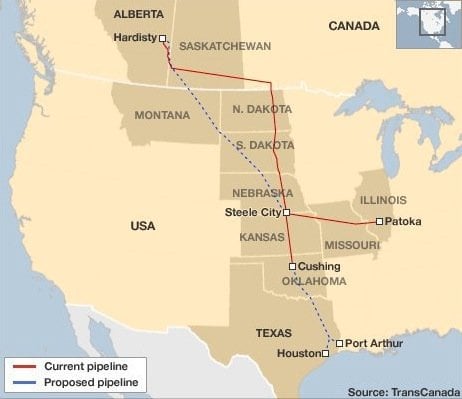

Another high-profile American, President Obama’s former national security advisor Tom Donilon, said yesterday that he would recommend the approval of the pipeline if asked. Donilon said that having more crude available to the US would enhance its energy security, giving the country greater leverage and ability to “hedge” against potential supply disruptions elsewhere. The Keystone XL pipeline would bring approximately 830,000 barrels of oil per day from Alberta to the US Gulf Coast.

In this country, the prime minister said he is still confident the project, with a price tag of $5.4 billion, will go ahead eventually. He noted, speaking in Vancouver, that there is widespread support for the pipeline “on both sides of the aisle, in both political parties, in both houses, and throughout the American economy and public.” President Obama, he said, did not say no, but “punted” on the question, meaning, according to Harper, that the president is still undecided.

It has been five years since TransCanada Corp. first applied to build the pipeline. The project has two sections, one of which is entirely within the US and does not, therefore, require presidential approval. That southern portion, costing $2.3 billion, runs from Oklahoma to Texas and is in the process of starting up. It will carry 700,000 barrels of oil a day.

As for the contentious northern portion of the pipeline, the head of TransCanada, Russ Girling is also optimistic, saying that he expects approval in the first quarter of this year.