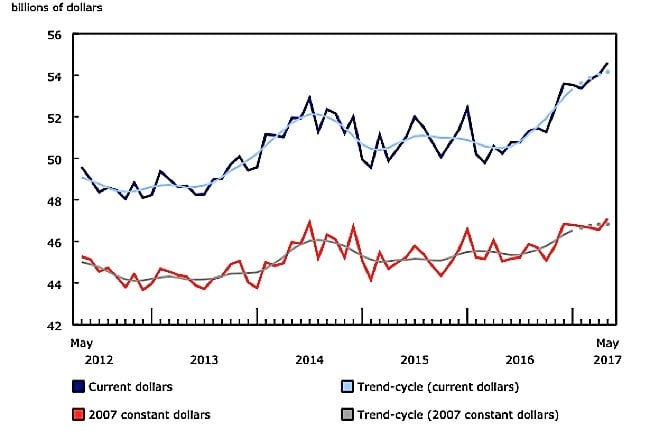

Overall monthly manufacturing sales are up again, for the third month in a row, rising 1.1 percent to $54.6 billion for May 2017. Inventories are also down 0.2 percent and unfilled orders are down 1.5 percent. The ongoing strength came from sixteen of twenty-one industries in the manufacturing sector with:

Overall monthly manufacturing sales are up again, for the third month in a row, rising 1.1 percent to $54.6 billion for May 2017. Inventories are also down 0.2 percent and unfilled orders are down 1.5 percent. The ongoing strength came from sixteen of twenty-one industries in the manufacturing sector with:

- durable goods rising 2.2 percent

- nondurable goods declining 0.3 percent.

Biggest gains in transportation equipment and chemical sales

Transportation equipment, which includes motor vehicle and motor vehicle parts, was a major driver of the gain, with an increase overall of $11.5 billion for May, or 4.2 percent up. Of this motor vehicle was up the most at 8.6 percent increase, while automotive vehicle parts were up 5.7 percent. The increase was in volumes rather than pricing for the most part. If you remove price changes from the analysis, sales volume rose 8.1 percent for motor vehicle and 5.0 percent for motor vehicle parts. This is the third straight month of gains for automotive.

Meanwhile, chemical manufacturing, which was down in the last three months, saw significant rises of 2.4 percent to $4.4 billion. The gains were across most categories but led by pesticides, agricultural chemicals and fertilisers.

On the opposite side, petroleum and coal were down 3.4 percent in this period to $5 billion. The shift here, however, was mostly price-based. The adjusted number, exclusive of price changes, was actually an increase in volume of 0.7 percent.

Ontario led the six gainer provinces

Sales increased in six provinces in May, led by Ontario.

Sales in Ontario increased 2.6% to $26.3 billion in May, their highest value on record. Growth in May was largely attributable to the motor vehicle (+8.7%) and motor vehicle parts (+5.8%) industries. These increases were partially offset by lower petroleum and coal product sales (-6.6%).

In Alberta, sales rose 1.3% to $6.1 billion, the seventh consecutive monthly increase. Sales were up in 11 of 21 industries, largely driven by gains in the chemical (+8.9%) industry and, to a lesser extent, the machinery industry.

Sales in Quebec fell 1.8% to $12.7 billion in May, following a 2.3% increase in April. The decline was mostly attributable to lower production in the aerospace product and parts industry and lower sales in the food industry. These decreases were partly offset by higher sales in the paper, wood product, and plastics and rubber products industries.

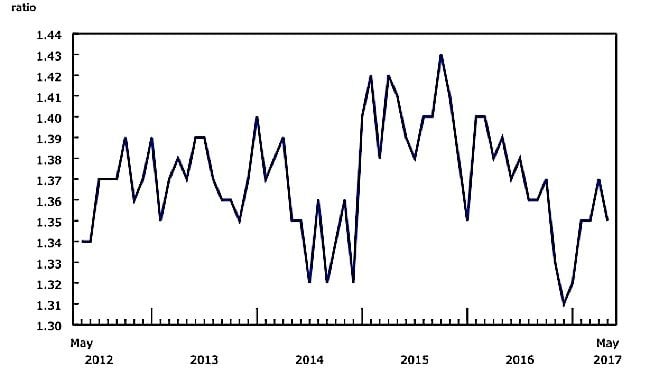

Inventory levels down slightly

Manufacturing inventory levels edged down 0.2% to $73.7 billion in May, following five months of gains.

Manufacturing inventory levels edged down 0.2% to $73.7 billion in May, following five months of gains.

Inventories fell in 8 of the 21 industries, with the aerospace products and parts (-2.6%) and the chemical (-2.0%) industries recording the largest declines. These decreases were partially offset by a 1.8% increase in primary metal inventories.

The inventory-to-sales ratio declined from 1.37 in April to 1.35 in May. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

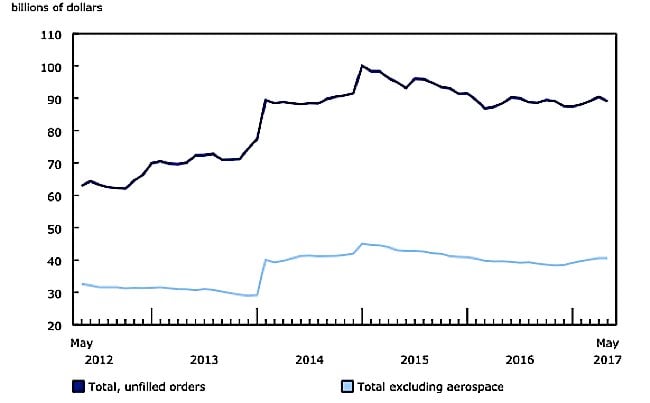

Unfilled orders declined

Unfilled orders fell 1.5% to $89.1 billion in May, following three months of gains. Most of the decrease was attributable to a drop in unfilled orders in the aerospace products and parts industry.