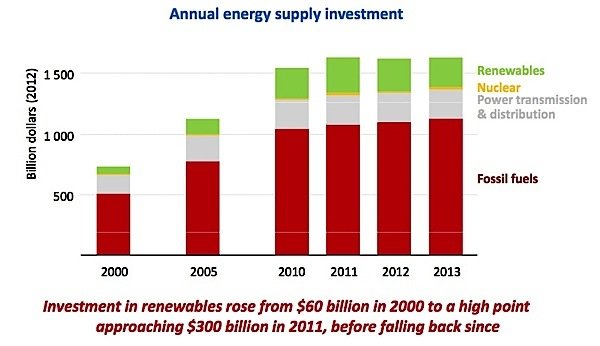

Perhaps one fact says it all: capital costs to produce energy have doubled since 2000. In 2013, $1.6 trillion was invested to provide the world’s consumers with energy, more than twice as much as was required in 2000. To maintain current levels of production and to meet rising demand in the next two decades, an investment of $40.2 trillion will be needed. An additional $8 trillion will need to be spent on energy efficiency.

For consumers of energy, the message from the International Energy Association (IEA), which released its World Energy Investment Outlook today, is not encouraging: despite massive amounts of new energy coming on stream in the form of LNG, and from renewable energy, prices for that energy will not be any lower. “Running fast to stand still” is how the report describes the next twenty years of investment in energy. Of that $40 trillion in new investment, most will go into offsetting declining production in existing oil and gas fields and to replace power plants and other infrastructure.

Financing the transition to a low-carbon energy system, the report warns, will be a “major challenge” that will only happen if governments take the lead with strong policy direction, and if it is sufficiently attractive to investors.

Policy makers face increasingly complex choices as they try to achieve progress towards energy security, competitiveness and environmental goals. These goals won’t be achieved without mobilising private investors and capital, but if governments change the rules of the game in unpredictable ways, it becomes very difficult for investors to play.

IEA Chief Economist Fatih Birol

As of now, about 15 per cent of annual investment goes into renewables, biofuels and nuclear power. The rest, which in today’s terms is over $1 trillion, goes to fossil fuels. That includes everything from extraction to refining to building of coal-fired power plants. The future of the world’s energy system depends on investment, says the IEA, but policy makers need to be clear and consistent in setting out their goals in terms of energy security, competitiveness, and the environment.

The difficulty for investors can be seen here in Canada. Just last week Total E&P Canada put an oil sands project in Alberta on hold, saying the company could not find a formula to make the $11 billion project work. Total is currently developing another Canadian venture, at a cost of $13.5 billion.

So far, the transition to low-carbon energy has not been successful, the IEA says. As part of the so-called 450 Scenario, governments have committed to keeping global warming to 2 degrees Celsius by controlling the burning of fossil fuels. Instead, if present trends continue, the world is likely to experience a long-term temperature rise of 3.6 degrees Celsius.