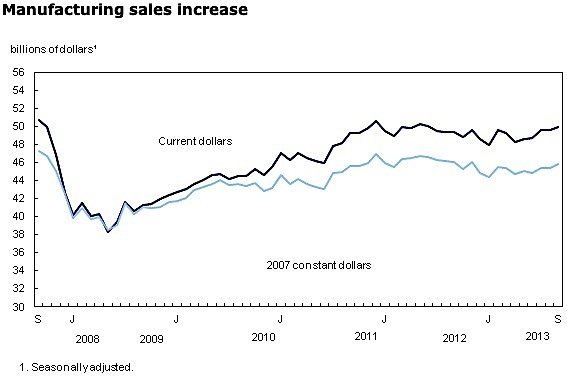

Canada’s manufacturers saw widespread sales gains in September, the fourth increase in five months. Sales rose in eleven of the twenty-one industries tracked, reaching their highest level since June of 2012, says Statistics Canada. Manufacturing sales rose 0.6 per cent to $49.9 billion, largely on the strength of the auto and food industries.

Sales in the motor vehicle assembly industry were up 5.4 per cent to $4.7 billion, the result of favourable market conditions and the introduction of some 2014 car models. Motor vehicle parts sales, meanwhile, rose 2.5 per cent to $2.0 billion. Sales in this industry had peaked in June, 2012, and declined since then. September was the third month of gains since that peak, Statistics Canada says.

Food sales experienced their biggest increase since December, 2012, rising 2.6 per cent to $7.5 billion. Higher grain and oilseed milling sales accounted for much of the gain.

Lower sales in the primary metal, aerospace product and parts, petroleum and coal product, fabricated metal product as well as the computer and electronic product industries offset a portion of the gains.

The greatest manufacturing gains were in Ontario, where sales increased 1.4 per cent to $22.9 billion, largely due to higher sales in the motor vehicle assembly, the motor vehicle parts as well as the chemical industries. A 5.2 per cent decline in the petroleum and coal product industry partly offset these gains.

The province of New Brunswick also saw significant gains, with sales up 16.8 per cent to $1.7 billion, the largest monthly gain in the province since March 2012. The increase reflected higher sales of non-durable goods. Saskatchewan’s manufacturers, meanwhile, sold $1.3 billion worth of non-durable goods, the highest sales ever recorded for the province.

Decreases in the petroleum and coal product as well as chemical industries in Alberta caused sales to fall 3.6 per cent to $6.3 billion.

Total inventories fell 0.9 per cent to $68.2 billion in September, but unfilled orders also decreased. Inventories have been generally trending upwards over the past several years, but September’s decline was the third in nine months. Unfilled orders in the aerospace products and parts industry helped push the total down 2.2 per cent to $71.9 billion. Declines in unfilled orders were also seen in the machinery industry and the electrical equipment, appliance and component industry. Excluding the aerospace industry, however, new orders were actually up.

For the year, manufacturing has increased overall by 1 per cent to date. The Bank of Canada is projecting 1.8 per cent GDP growth for 2013.