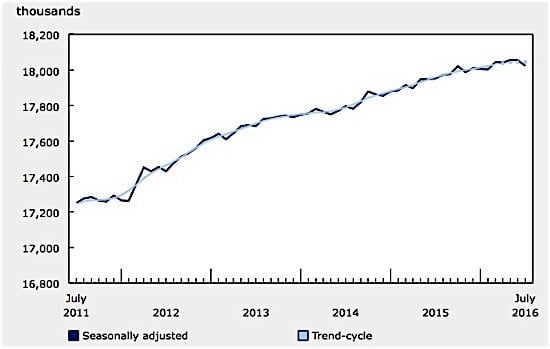

Canada’s employment statistics for July were disappointing and, as is often the case, worse than economists had expected. The country lost 31,000 jobs, enough to lift the unemployment rate by one-tenth of a percentage point to 6.9 per cent. Hardest hit were youths aged fifteen to twenty-four. This demographic lost 28,000 jobs, all of them part-time work. Among other age groups, Statistics Canada says, employment was little changed. Despite large losses in Ontario, where employment decreased by 36,000, the unemployment rate remains at 6.4 per cent.

But in Alberta, where the employment level was essentially unchanged, the unemployment rate rose 0.7 percentage points to 8.6 per cent, the highest it has been in twenty-two years, as more people were looking for work. Alberta has lost 104,000 full-time jobs in the twelve months to July, and the reason is ongoing problems in the oil patch.

Those problems are expected to continue, though a new report from CIBC Economics says the oil industry will improve slightly in the next few years. However, the days of soaring, $100-a-barrel oil are not likely to return. Oil is selling for around $40 a barrel currently, but could rise to $60 this decade. Only when supplies begin to dwindle will Canada return to full production mode, the report says, and only then will oil prices modestly rise.

For Canada’s economy, crude prices are likely to remain beneath the level needed to spur a significant acceleration in oil sands investment through the end of this decade. The worst of the downturn might be behind the oil patch provinces, and fiscal stimulus could give Alberta a temporary respite, but the trend in potential growth for oil-producing provinces looks to be more modest for the remainder of this decade.

Emerging markets, mainly China, are the “swing factor” for oil demand, says CIBC. Whereas consumption in the mature markets is at risk of stagnating or shrinking, as governments’ environmental policies promote electric cars and other carbon-free strategies, China still relies heavily on fossil fuels. China’s per capita energy use, however, is far below that of higher-income countries. China’s growth will power continued increases in crude consumption; the question is, how fast will this happen? In 2015, emerging market demand for crude grew “an impressive” 1.4 million barrels per day, largely driven by low prices, but this rate will not be sustained, CIBC says.

As for Canada, crude prices are likely to remain beneath the level needed to spur significant acceleration in oil sands investment for the rest of this decade, CIBC says. Even if the worst of the downturn is behind the oil-producing provinces, and fiscal stimulus providing a temporary respite, the growth trend for the rest of the decade looks to be modest. A positive result of that will be a less upwardly mobile Canadian dollar, and that will continue to benefit Canada’s exporters. The rotation will be slow, but non-energy exporting industries will have to carry the next leg of the Canadian recovery.

Those exports have been weaker than they will have to be to fulfill this role. In June, the country’s trade deficit with the rest of the world grew to $3.6 billion, a record. For the second quarter of 2016, Canada’s trade deficit with the world widened to $10.7 billion, also a record.