Renewable energy stands poised to lead the world in new electricity supply, according to the International Energy Agency (IEA). In 2014, renewable power generation expanded at its fastest rate to date, representing almost half (45 per cent) of overall additions to global supply of electricity. Falling costs of renewable generation and increasing participation among emerging economies will support continued development of the renewable option. Energy-hungry nations like China and India will account for an increasing share, more than two-thirds, in the deployment of renewable energy sources, the IEA says in its just-released Medium-Term Market Report on renewable energy.

Even with world oil prices having fallen, the IEA is optimistic that the factors driving demand for renewable electricity remain “robust,” factors that include a desire for energy diversification, the need to control local pollution, and the desire for reducing carbon emissions. Renewables are forecast to be the largest source of additions to power capacity over the medium term, accounting for nearly two-thirds of expansion by 2020. The renewable share of total generation will rise from 22 per cent in 2013 to 26 per cent in 2020.

While this gain is substantial, it “falls short of what’s needed” in order to meet longer-term climate change objectives. Slowing the deployment of renewable energy generation are “policy and market integration uncertainties” in Europe and Japan, as well as financing and integration challenges in developing countries. The executive director of the IEA, Fatih Biral, said that it is up to governments to “remove the question marks” over renewables if these technologies are to achieve their full potential.

The greatest increase in renewable power generation has been in onshore wind, which represents more than one-third of capacity and of generation increase. Solar accounts for another one-third of capacity, while hydropower makes up one-fifth of new additions. Offshore wind is expected to more than triple by 2020.

Affordable renewables are set to dominate the emerging power systems of the world. With excellent hydro, solar, and wind resources, improving cost-effectiveness and policy momentum, renewables can play a critical role in supporting economic growth and energy access in sub-Saharan Africa, meeting almost two-thirds of the region’s new demand needs over the next five years.

China is clearly the biggest market for renewables going forward. According to the IEA report, With its huge generation needs, pollution concerns and a “favourable policy environment” that supports ambitious targets, China alone will require about one-third of all new investment to 2020. India’s renewable growth is also poised to accelerate, the report says, with ambitious new targets for solar PV and wind.

As for the effect of lower oil prices on renewable power deployment, it is “more perception than reality,” according to IEA, having a greater impact in the transport and home heating sectors than in the power generation sector. Only certain oil-fired power plants benefit directly from lower oil prices. The attractiveness of renewables relies more on “policy support and appropriate market design.” Persistent uncertainties in these areas pose a far larger risk to renewables adoption, the study says.

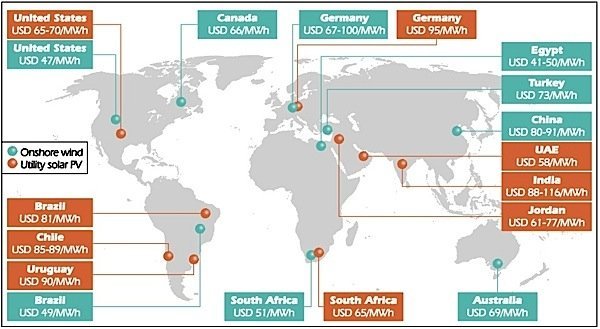

Meanwhile, costs of generating power from renewables are forecast to continue falling. Between 2010 and 2015, onshore wind generation costs for new plants fell by an estimated 30 per cent on average, while those for new utility-scale solar PV declined by twice as much. In both cases, costs are forecast to decline from 10 per cent to 25 per cent more by 2020.

This improving price trend does not necessarily mean that renewables are competitive with fossil fuels at this time, however. Other factors, including the value of the generation and the system costs of integrating it, as well as the “hedge value” of renewables against fuel price volatility must also be accounted for.