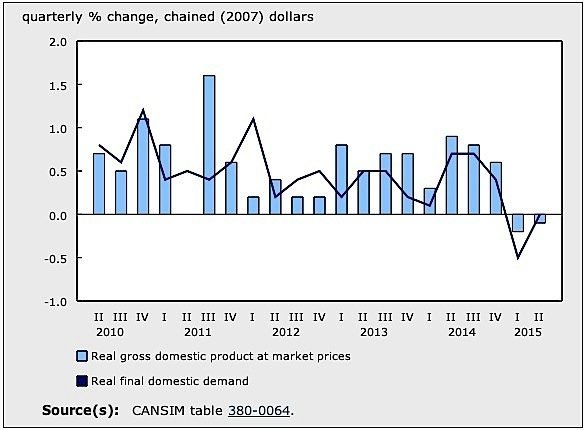

As recessions go, most commentators agree that this is a mild one. Canada’s real GDP shrank 0.1 per cent in the second quarter, following a 0.2 per cent contraction in the first quarter, according to Statistics Canada. In annualized terms, the second quarter contraction is 0.5 per cent, nowhere near as severe as the 8.7 per cent decline in the first quarter of 2009, the height of the Great Recession. Employment was actually up in both quarters, as was consumer spending. Still, a contraction is a contraction, and current conditions meet the technical definition of recession: two consecutive quarters of negative economic growth.

It doesn’t help that in the US, GDP grew by a robust 3.7 per cent in the same period. An improving US economy is constantly given as the main hope for a Canadian recovery. The other given is that a lower dollar is good for Canada’s exporters. With both of those conditions in place, why has Canada fared so poorly, relatively speaking? Falling business investment as a result of low oil prices and slowing global growth seems to be the answer, though some of Canada’s big bank economists are pointing out that the economy may have turned a corner in June, and that the recession, just announced, is already “in the rear-view mirror.” GDP rose 0.5 per cent in June in a broad-based increase that included mining, oil and gas, manufacturing, agriculture and forestry. Both TD and BMO are still forecasting 2.5 per cent growth in the third quarter, though oil prices are something of a wild card for Canada’s resource sector.

In the event, business investment declined in the second quarter, particularly in non-residential real estate and in machinery and equipment, down 3.1 per cent. Investment in industrial machinery and equipment was off 11.6 per cent. There was also a 4.1 per cent decline in new home construction and a 33.2 per cent mining sector drop in outlays for mineral exploration.

The mining, quarrying and oil and gas extraction sector posted a “notable” decrease of 4.5 per cent, the second consecutive quarter of decline. Non-conventional oil extraction dropped 5.7 per cent while support activities for the mining and oil industries fell 18 per cent.

Manufacturing, construction and utilities were all down in the second quarter, though manufacturing output grew in June, up 0.4 per cent.

On the positive side, household spending increased by 0.6 per cent in the second quarter, especially on durable goods, which rose 1.6 per cent. Canadians spent more on cars and trucks, insurance and financial services, food and beverages, and accommodation services. Home renovations were also up, partly offsetting the drop in new home construction.

Exports, bolstered by the weakened Canadian dollar, were also up slightly, rising 0.1 per cent overall after two quarters of decline. Cars and car parts made up the largest export category, up 4.7 per cent. Crude oil and crude bitumen exports also rose, by 3.3 per cent. Consumer goods contributed to the partial export rally with a 1.8 per cent increase. On the negative side were declines in exports of metal and mining products, as well as a range of services.